Seeking Safety in Long-Term Treasuries

November 1, 2022

Since the low points of the Great Recession in 2008, markets have been essentially generating positive returns on an overall basis. For those that stayed invested in the markets, even when the going got tough in 2008, their steady hands (and minds) allowed them to prevail and benefit as the markets recovered. As we have transitioned into 2022, we as investors have encountered an overwhelming amount of uncertainty. As always, the decisions we make today can not be motivated by the past, but must instead focus on the future.

Much of this uncertainty has had a direct connection to inflation, rising interest rates, and the geopolitical concerns associated with the conflict throughout Ukraine. These factors, while important, support age-old wisdom however, which is that markets always have and always will provide reasons to be concerned. In relatively simple terms, markets go up and markets go down. The reasons can and will vary, but if you maintain focus on your personal circumstances, and your personal planning objectives, then you can shield yourself from a lot of the noise, and focus on the long-term trends, rather than the short-term fluctuations.

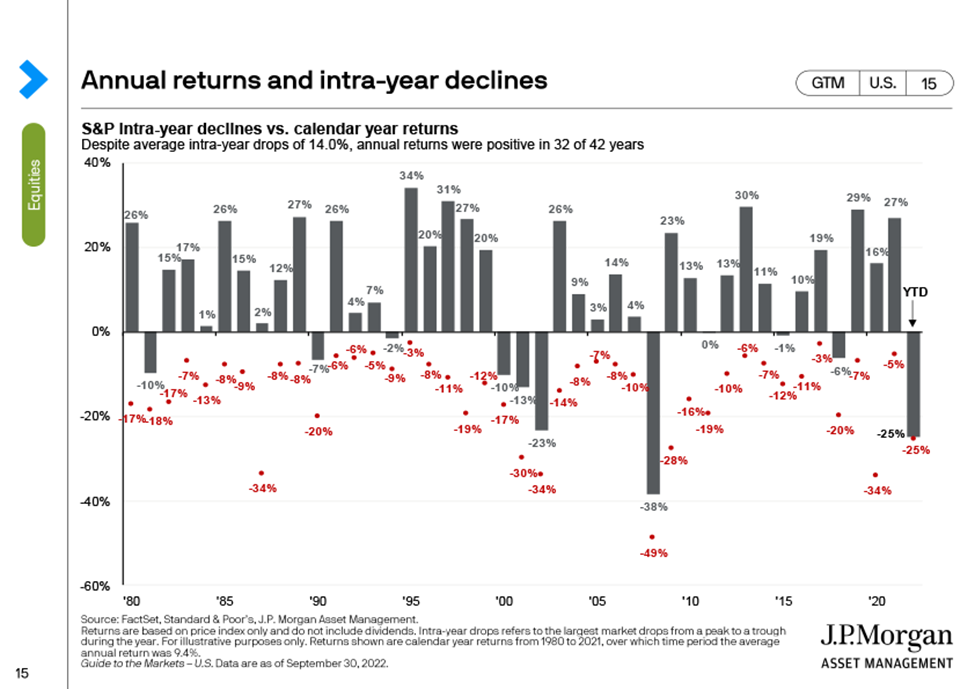

While no one will ever guarantee a positive rate of return, especially within a singular calendar year, it is important to use data and historical trends to understand the degree to which markets both rise and fall. As shown in the following chart, since 1980 market returns within the S&P 500 over the last 42 years were positive 76% of the time. This is despite the fact that there has been an average drop of 14% in every single one of these years as well. The point is that you should expect this to be a bumpy ride, but that despite turbulence being common, with the right planning and the right mindset, we can all arrive safely at our destination.

So, how do we get there? The most common rule associated with real estate when making a significant investment is…location, location, location! In a similar sense when it comes to investing, the most common rule is… diversify, diversify, diversify! For the average individual, this typically results in discussing stocks and bonds, which is a fantastic starting point. The general guidance is that when stocks go down, bonds go up. While there have been years where it has been demonstrated that this standard is not flawless, the truth remains that bonds maintain significant merit when you consider how to invest. While the type of bond that you invest in can vary to a significant degree, it is not uncommon for concerned investors to reduce allocations to stocks and raise their holdings of bonds, especially long-term U.S. Treasuries, when markets become seemingly less predictable. While safe havens can commonly be challenging to locate, in years past, historical performance shows that treasuries have thrived even in challenging markets.

Many are familiar with the adage associated with a 60/40 portfolio, which is to say that upon retirement, an appropriate investment allocation is 60% in stocks and 40% in bonds. The theory here is that this will allow you to maintain (or perhaps even slightly grow) the amount that you have saved throughout your lifetime, while generating income to offset your day-to-day needs that previously were accounted for through the income earned within your chosen profession. Furthermore, many will argue that as you approach retirement, this target of 40% should be reached gradually, and as you progress through retirement, you may even want to increase your overall investment within bonds simply to ensure that you are comfortably conservative. Of course, there are serious considerations that need to be made respective to this advice, and it is important to consult with a financial planner to understand how and if this is appropriate for yourself and your family.

Additionally, the question often arises as to what type of bonds you should invest in? U.S. Treasuries have significant advantages, but there is no perfect investment, and you should consider what other options may be available. Do you consider corporate bonds? Municipal bonds? Series I savings bonds? Short term or long-term debt? Investment grade or high-yield debt? How often should you be reviewing your fixed income investments and consider shifting your approach to accommodate changing market environments? Fixed income is not necessarily a road without potholes, which is one more reason why working with a professional can be a valuable means of ensuring that you keep your eyes on the road ahead of you.

As you might expect for an investment with less risk, yields on long-term treasuries are modest in today’s environment, even as interest rates are rising. However, this doesn’t mean that they are negligible even as inflation continues to be a present concern. In fact, the current interest rate on a 10-year treasury bond is approximately 3.4%, which is more than what is currently being offered through the likes of savings accounts, certificates of deposit, and money market funds.

By now you may be asking yourself how you invest in bonds of this nature, and of course the answer to that question is more involved than you may expect. The most common ways in which bonds are incorporated into an investment portfolio is through mutual funds and exchange traded funds. However, certain bonds such as treasury bonds may also be purchased directly through the US Government. For those seeking a more personalized approach, custom portfolios of individual bonds may also be the best solution.

Every strategy has its advantages and they should all be thoughtfully considered. The two most common considerations are the low fees associated with most fixed income mutual funds and exchange traded funds, and the tax advantages of treasury bonds, as well as municipal bonds. The latter is especially important as you consider that interest from treasury bonds is exempt from state and local income tax, while municipal bonds can be exempt from federal taxation as well. Thus, treasury bonds and municipal bonds may be an appropriate strategy for those residing in high-tax states such as New York and California.

Please bear in mind, there are many characteristics of bonds that should be considered, including risk factors. As inflation continues to impact all of us, and as interest rates keeping rising in an effort to keep inflation in check, we must remain cognizant of how this will affect even the safest parts of our investment portfolios. It is important to remain aware of the fact that in typical markets, as interest rates rise, those higher interest rates will bring down bond prices, and this can be particularly impactful to long-term bond issues. This occurred in 2009 and 2013, when long-term government bonds lost 15% and 11% of their value, respectively, and its happening again in 2022 as we consider that the U.S. Aggregate Bond Index is down about 12% as of this writing. As such, some investors may feel that buying fixed income that provides only some safety and potentially lower yields, is not justifiable from a risk-return perspective. This may lead to broader conversations associated with what other strategies are available and we would be pleased to help educate you on what some of those options may be.

While markets fluctuate, we continue to advocate for reviewing how much risk you are willing to assume within your investments, and to ensure that that amount aligns with your financial planning objectives. As you consider your goals and how Treasuries and other types of bonds may work to help you meet those objectives, you should be sure to pay close attention to the advantages, the risks, and your options. The foundation of our practice is to counsel and educate our clients and we welcome the opportunity to review this important matter with you.